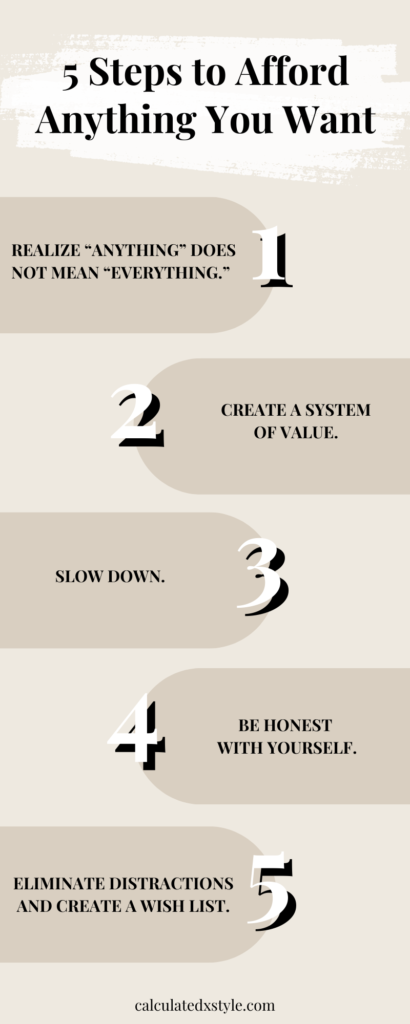

Afford anything you want in 5 simple steps.

1. REALIZE “ANYTHING” DOES NOT MEAN “EVERYTHING.”

The first—and most important—step in affording anything you want is to realize that “anything” does not mean “everything.” We live in a world that is driven by consumerism which, if left unchecked, causes us to constantly want more than what we have. This is especially true with fashion and clothing. Trends are constantly changing. The seasons change. Sales tempt us. Influencers show you their newest finds. And most of us would go broke if we purchased every single item that we wanted.

Wait…I thought I was learning how to afford all this stuff? You’re telling me I can’t.

As promised in the title of this post, you can afford anything you want (and have the wardrobe of your dreams!) …but you can’t afford all of it. The sooner you accept (and actually act on) this concept, the quicker you will see amazing results in your personal style and in your bank account.

This philosophy is not meant to be a #lifehack on how to spend all you want without consequences.

This philosophy is going to teach you how to have amazing personal style made up of high-quality pieces all while spending less money along the way.

Spending less money? I thought this was a fashion blog. I don’t need financial advice.

Yes, you do. Fashion and personal finance are inherently linked by the simple fact that everything costs money. This means it is impossible for you to afford anything you want and build the wardrobe of your dreams without talking about money. And here’s the good news: it doesn’t take much money to curate amazing personal style. All of us—no matter income level—have a set amount of money we can spend. This means that to afford anything you want you must be very calculated in what you decide to spend your money on. Being calculated about your purchases requires significantly more thought and effort than deciding to buy a new top because it’s on sale and you haven’t bought anything in a while. Simply being able to afford something that you want is an insufficient reason to click “check out” because it inhibits you from being able to afford the things you really want. In essence you can afford anything you want if you don’t spend money on everything you want.

Okay…so how do I know when I should actually purchase something? How do I know when it’s worth it?

2. CREATE A VALUE SYSTEM.

This naturally means you have to rank things in your life; and to rank things we need a value system. You can’t possibly determine if you want A more than B if you don’t know what the measuring stick is. And let me break something to you, desire only is a poor, poor measuring stick. In a decision to purchase a piece of clothing you cannot rely only on your desire for the piece, because our desires are fickle. Your value system could be to own less clothing (i.e., don’t own duplicate pieces or pieces that perform the same function in your closet). Your value system could be to spend less money overall. Your value system could be to own more high-street (or even designer) pieces. It could be to wear less man-made materials. There is not a single correct value system, everyone’s will look a little different. Here is my value system as an example:

- No repeats—do I own something that fills the exact same function in my wardrobe?

- Minimal synthetic fibers—no polyester, acrylic, or other man-made fibers (as much as possible).

- Cost per wear—how often will I wear this item relative to its cost?

- Versatility—how much does this match other items I already own?

- Preference—is there something else in my closet that I like more for the same occasion? I.e., will I always pick something else over this?

- No fast fashion. Period.

When I am considering buying an item I run it through my value system above. If it passes, great! I can seriously consider the purchase. You know when it’s worth it to purchase an item when it aligns with the value system for your wardrobe. Now that you have the value system to check against…

3. SLOW DOWN

There is a time for treats, but that time cannot be every time you see something new. In today’s world that treat time does feel like all the time. This is for 2 reasons (1) keeping up with the Jones’ is here more than ever with social media – that’s not a surprise. But even if you think you’re able to resist that you can’t resist the natural change in the way of life which is our second reason, (2) speed. Everything happens so fast – see the link, follow it, automatically apply the discount code you got from the advertisement, check out, have the item in 2 days. You are functionally allotted no time to ponder your purchase and that is intentional. And guess what? Since life is moves so fast and you’re a busy person you’re likely not returning it. Because you’ve forgotten. You’re onto the next thing. What next thing? Another treat that was a seamless 3 clicks away from an Instagram story. It’s all so fast that you’re not processing the action of the purchase. Which makes it forgettable. This means that the next time a “treat” item were to come along you think you deserve it because you forgot you did it 2 weeks ago. “But these aren’t serious purchases! I would think about a major expense.” That’s right. I believe you. I don’t think (at least I hope not) that the average person is treating themselves habitually without second thought on luxury or high-street purchases—a few are out there, but it’s not common. No, the average person is treating themselves on sub-$50 items. Let’s do an exercise.

- Sale earrings from Bauble Bar – $17.99 (originally $24.99…score!)

- 15% off your first purchase on a high-street site! What a deal! That’s a treat item for sure, but hey, it’s 15% off and they never issue coupon codes. – $60.00

- New makeup brush cleaning tool (it looks high tech – goodbye soap and elbow grease!) – $19.99

- “The perfect boot socks” all those bloggers have been pushing. They’re only $14.99 for a pack of 10 on Amazon – look at me not falling for that expensive Bombas brand! Glad I found a dupe.

- Subscription box automatic renewal – $49.99

You’ve spent a whopping $163 without hesitating. But you would hesitate to think about a $163 single item. Here’s the problem (well, one of them). Those were impulse treats not even on your wish list (more on wish lists below). So, despite the fact you spent $163 frivolously, you’re STILL pondering a $150 wish list item on its own. You end up buying it because you “haven’t had a big purchase in a while” and now you’re over $300 in the hole. In a month. Potentially less. But I’ll give you credit. Say it’s a month. No, I’ll give you more credit than that. Say it’s 2 months and we’ll round down to a flat $300. That’s $1,800 a year on shit you do not need and 85% WASN’T EVEN ON YOUR WISH LIST. So what happens when you actually need things? Bras crap out over time. Makeup runs out. We all get new underwear occasionally. That white top you wear to the office all the time has a permanent stain. Your sneakers are falling apart. These are all justifiable expenses that you won’t think twice about…but they happen ON TOP of that $1,800 a year (minimum) that you spent without thinking…on “treats.” I won’t even estimate that expense, but I’ll be forgiving. You probably double the money—meaning you spend $300 every 2 months on things you need (on average). That’s $3,600 a year. That’s a whole vacation. “But but but I NEEDED half of those things! Don’t hold that against me.” I’m not! What I’m arguing is that you should spend that $1,800 that was required to maintain your closet…and then held off on 95% of the rest. This allows you to easily treat yourself with things you actually want and have a pointed desire for without feeling the guilt of the splurge or investment. If that $1,800 had stayed in your pocket just by changing behavior for ONE YEAR you could get a $500 pair of boots or trench coat or fine jewelry that will last you well over a decade if not your life (in the case of jewelry) and you pocket $1,300 dollars. That’s $9,000 after a modest 5% growth rate after only 5 years.

And here’s the funny thing about that $500 you spent. Say you bought nice solid gold (or white gold) jewelry that you LOVE. You will reach for that every time vs the Bauble Bar costume jewelry that’s already in your drawer. This means you de-clutter and are never tempted by the costume jewelry sale ever again because you have something you like (love) substantially more. This logic can be applied to almost every category.

Bottom line: Slow down. Use the system of value from point #2 to check yourself. Does it fit into the value system (e.g., look more chic, slowly replace fast fashion, dress in natural fabrics) you created for yourself? Just slow down and think about it.

4. BE HONEST WITH YOURSELF

This is cliché but it is also critical to this process. You simply must be honest with yourself. About everything. And this includes deeper introspection than you might assume for something as simple as clothing. There are a myriad of reasons that you might want a new top, and you need to ask yourself, “Why?” not just one time. No. You need to ask yourself, “Why?” what seems to be a ridiculous number of times for what feels like you’re nearing infinite regression to get to the real honest reason you want that new top. Because a vast majority of the time the answer is not simply that it’s cute.

- Clothes don’t fit anymore? Go to the gym if you’re not feeling your best. Don’t buy a new wardrobe that you hopefully won’t need in the future. Get your clothing tailored if that option is available to you.

- Outdated? You’ve given into trends too much in the past. Learn from your mistakes as you move forward.

- This looks like a top Person X would wear/does wear. Why do you want to look like Person X? Do you feel the need to “keep up with the Jones’?” Why? Does seeing Person X in cute clothes you don’t own make you feel inadequate? Jealous? Why?

- I like it more than a top I already own. That’s fine! Do you HATE the top you own now? Why? Does it not fit? Is it outdated? Was it an impulse purchase? Learn from your mistakes as you move forward.

- Shopping makes me happy. New things are fun. Yes! New things are fun. But that dopamine hit you’re getting from spending will be gone tomorrow, so unless this top aligns with your system of value and you’ve slowed down to think about it, maybe hold off.

There are infinite reasons you may want an item. Some will be healthy, and some will not be. Sometimes you will genuinely need an item (hello dingy white layering t-shirt that needs to be replaced). Regardless of the reason, you need to go through the process and be honest with yourself as to what those reasons are. The more you do this the more you can cut through the noise and cut your spending on items you want for the wrong reasons.

5. ELIMINATE DISTRACTIONS AND CREATE A WISH LIST.

This point is really wrapped up with points #2, #3, and #4—you must eliminate distractions. Between social media, targeted ads, marketing emails from all our favorite stores, and who knows what else, we are constantly berated with items to purchase. And because marketing professionals are so damn good at their jobs these items are really, really distracting. The bad news: when these items distract you successfully (i.e., you spend your hard-earned money on them) you now have less money to purchase the items you want/need. The good news: with a little discipline it’s easier than you think to eliminate the distractions. You can do this by creating a wish list. Your wish list can include items you want, love, need, and dream items you might never actually pull the trigger on. It can be specific, or it can be generic (think “that one jacket I saw at Nordstrom” versus “my black boots are really beat up and I need a new pair before the Fall”).

The key here is you must make a real list—not just rattle off the items in your head. It can be on paper, a note on your phone, a word document, whatever medium works best for you…it just has to be a tangible list. This will help you be more targeted as you’re confronted with yet another 20% off code from an influencer. Rather than use that 20% off code on a distraction item that you are only getting because you saw it in a try on haul, see if you can use it on something on your wish list that you have a genuine need for—like those black boots you need to replace. The list gives you something to refer to…write it down as to not forget it and all that.

While that covers the “need” items on your wish list, what about the “wants”? By eliminating the distractions (and not purchasing items you otherwise would have) you can save and set aside money to put towards those other items on your wish list. By using points #2 and #3 above to dwindle down items you are normally tempted by you will start to purchase less. A lot less. This not only saves you money but also gives you the ability to purchase an item on your wish list that you LOVE that passes every test above with flying colors and can become a favorite in your closet.

If you make an honest attempt to follow these 5 steps you will be on your way to the wardrobe of your dreams in no time. You will spend less. You will own less. And you will look—but most importantly, feel—better.

Leave a Reply